closed end loan examples

Examples of closed-end loans include a home mortgage loan a car loan or a loan for appliances. Last updated in June of 2021 by the Wex Definitions Team.

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Auto loans typically work the same way but the term of the loan is much shorterfor example a sixty month 20000 auto loan with a 3 interest rate.

. The loan may require regular principal and interest payments or it may require the full payment of. Is offered by a lender only when the borrower provides collateral for the loan. Both of these loans are common examples of closed-end credit.

A closed-end signature loan is a type of personal loan that is typically available to people with good credit. A closed-end loan is a loan such as an auto loan with fixed terms and where the money. A borrower may repay the balance before the payments are due and the loan is usually smaller than a closed-end loan.

The length of the loan will affect how much you end up paying overall. By contrast open-end loans such as credit cards can have the amount owed go up and down as the borrower takes money against a credit line. Although these loans usually have a specific purpose a personal loan that you can borrow for any purpose also falls under the closed-end credit category.

Closed End Credit Examples. Unlike a credit card which is an excellent example of an open-end loan closed-end loans do not allow borrowers to continually access new funds when they have paid back a portion of the original borrowed amount. With traditional open-end mortgages youd be free to borrow against that 200000 in the form of a home-equity loan.

When you borrow money with a closed-end loan you are agreeing to make installment payments which include principle and interest divided in equal amounts and applied to a repayment. The purpose product sale price loan amount loan term and. Credit cards and open end credit are very similar because the borrower controls how much to borrow.

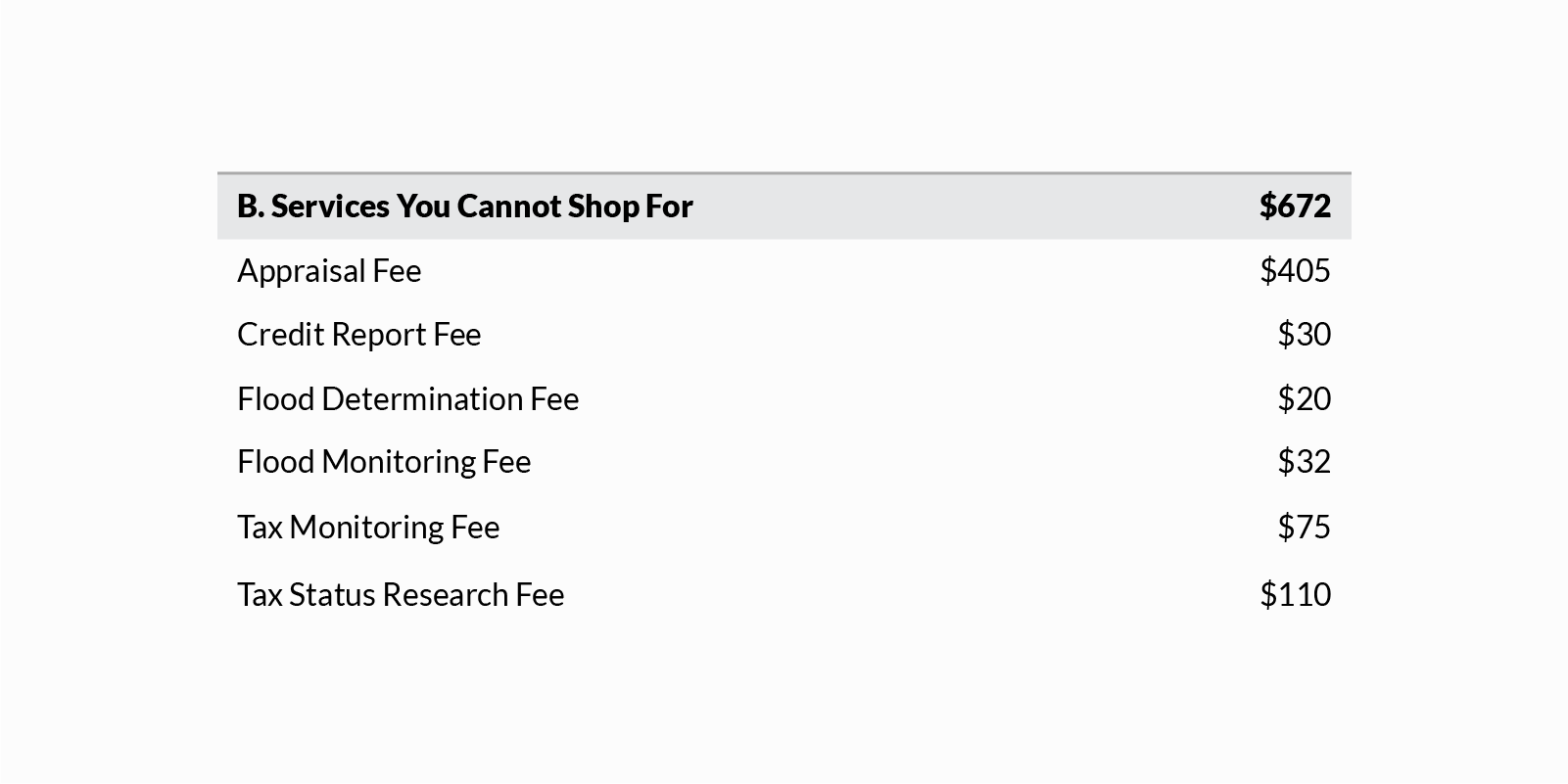

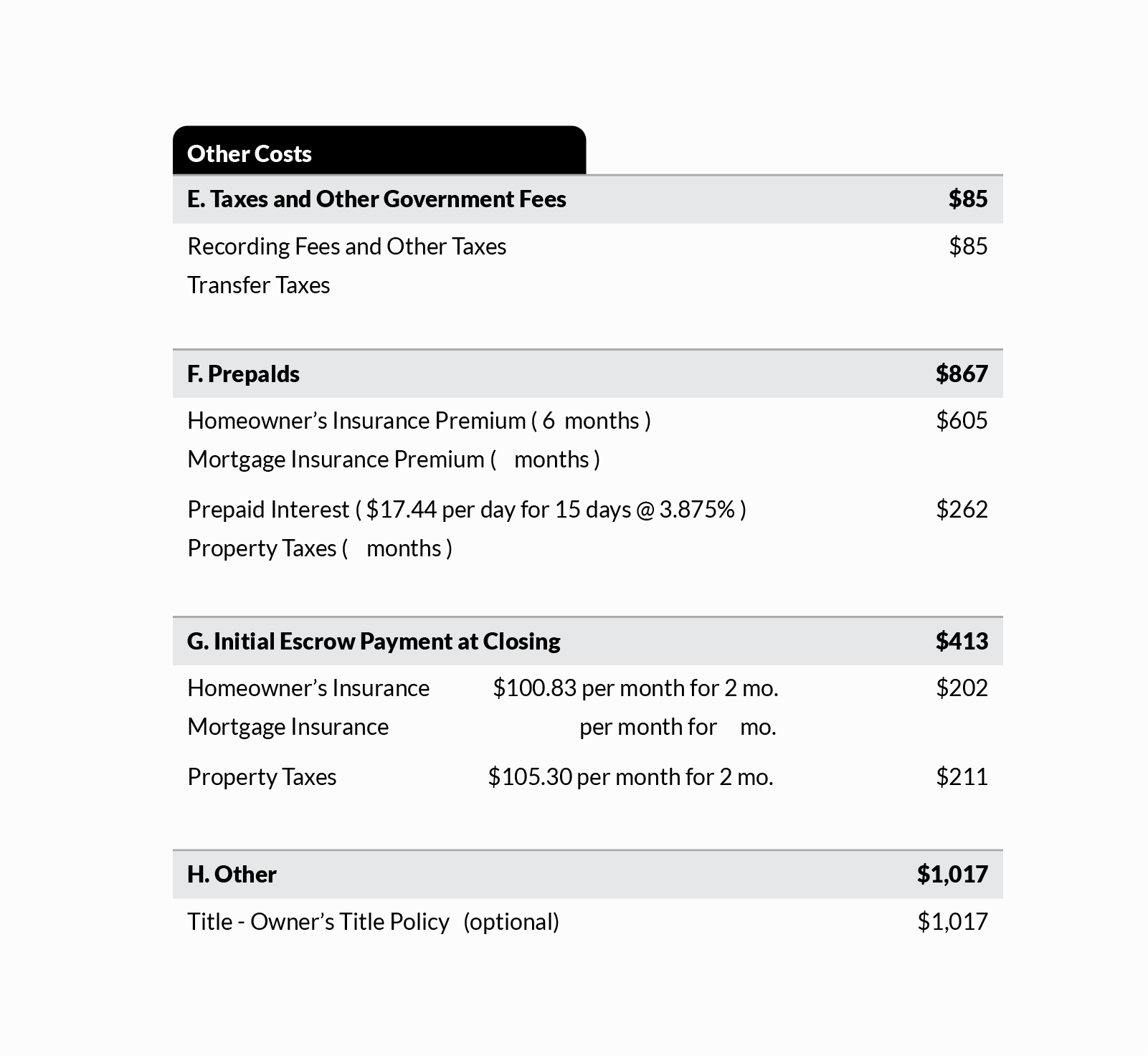

Learn More. This is a sample of a completed Closing Disclosure for the fixed rate loan illustrated by form H-24B. The most common examples of closed-end credit are mortgages and auto loans where the purpose of taking out a loan is known and definite.

By comparison loans for a predetermined amount such as auto loans are considered to be closed-end loans. 4 The amount of any finance charge. That is contrasted with a home equity line of credit where he is granted the right to draw down an amount up to the total value of his line of credit.

There are also instances of closed-end credit in which no monthly payments are. Once the funds have been transferred to the borrower they must be paid back entirely to satisfy the terms of the borrowing agreement and conclude. Payments on a Closed-End Loan.

An example of closed end credit is a car loan. In other words the borrower has the right to tap into the credit made available to. Trigger terms when advertising a closed-end loan include.

When a borrower receives a lump-sum amount from a home equity loan it is referred to as a closed end home equity loan. 2 The number of payments or period of repayment. Also Know what are the three most common.

Stating No downpayment does not trigger additional disclosures. If any of the above trigger terms are present. Open-end loans offer you the chance to borrow as much or as little money as you want up to a certain amount and then pay back some or all of the funds monthly.

Mortgage Loan is an Example of a Closed-End Credit. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card. The difference between closed-end credit and open credit is mainly in the.

A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed. 1 The amount or percentage of any downpayment.

A closed end home equity loan is often written for 15 years. Closed end credit has a set payment amount every month. Generally with closed-end credit the seller retains some form of control over the ownership title to the goods until all payments have been completed.

For example a car company will have a lien on the car until the car loan is paid in full. There are a few common ways you may use closed end credit such as. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date.

H-13 Closed-End Transaction With Demand Feature Sample. Auto loans and boat loans are common examples of closed-end loans. 3 The amount of any payment.

With open-end or revolving credit loans are made on a continuous basis as you. Another source of credit is credit card companies like visa mastercard American express and discover. For example if a customer fails to repay an auto loan the bank may seize the vehicle as compensation for the default.

An example of a closed-end loan is a mortgage loan. Unsecured Closed End Credit. CEC loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date.

Personal lines of credit and credit cards. H-25B Mortgage Loan Transaction Closing Disclosure - Fixed Rate Loan Sample. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms. If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender. Meaning pronunciation translations and examples.

Such a loan is set up with fixed payments that cover both the principal amount of the loan and the interest due over the life of the loan. A closed-end loan is also known as an installment loan by traditional lenders. However the primary form of mortgage in the US is the closed-end mortgage.

Youd do it by putting up the house as collateral for the new loan. For example if you.

Understanding Mortgage Closing Costs Lendingtree

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Understanding Mortgage Closing Costs Lendingtree

Understanding Finance Charges For Closed End Credit

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Understanding Mortgage Closing Costs Lendingtree

Open Vs Closed End Leases What To Know Credit Karma

Home Equity Line Of Credit Statement Overview

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Consumer Loan Types And Categories Of Consumer Loan With Example

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)